When you invest, you are buying a day that you don’t have to work!

– Aya Laraya

Papa, how do I invest my earnings and savings?

That’s the sweet sound of a young coming-of-age Zoomer taking flight in life – a milestone that every parent looks forward to! This summer my first-born graduated and started work. As her paychecks rolled in, she was looking for options to save and invest. I figured, it’s best to write an informational blog post on this topic and let her make the decision. So here it goes… investment options for a Zoomer to grow their money for the long term.

Investment Options: Today, Zoomers face a bewildering array of choices to deploy their savings. Here are 10 common investment choices – with the lowest risk/reward option on the top and the riskier yolo options at the bottom:

- High Yield Savings Account: To combat post-covid inflation, US Federal Reserve has hiked interest rates 11 times starting March-2022. As a result, banks are now offering a healthy 4%+ interest rates on their high yield savings accounts. Zoomers with their iPhones can quickly open an online Apple Savings Account and get about 4.1% return – see how Apple Savings stacks up against other similar competetitors.

- CDs (certificate of deposit): Similar to HY savings accounts, CDs are available in the realm of 4.25% for 4-months or 3.75% for 11-months. Unlike HY savings accounts, your funds invested in a CD are locked up for that term period. It’s interesting to note that we are in an unusual inverted yield curve era where the return for the short term maturity is higher than the ones with a longer term maturity.

- Bonds: Bonds are fixed interest investment option where you lend your money to municipalities, corporates or government. The return depends on who you are lending it to, their credit worthiness and the term of the bond. Some municipal bonds can also be tax free.

- Real Estate: Once you have some capital built up, you have the ability to buy a condo/house, become a landlord and collect rent. Your rate of return is a combination of rent collected plus the property appreciation over the years. Residential real estate return is in the ballpark of 6%-8% – but you have to spend a non-trivial amount of time being a landlord (e.g. finding renters, broken plumbing, bum renters not paying on time). If real-estate is your thing, here’s a good article to read on buying real-estate vs a REIT.

- Index funds: You can invest in a broad market index fund like SPY (S&P 500), tech heavy index QQQ (NASDAQ 100) or other such options. SPY’s 10-year annualized returns are ~13% while QQQ’s 10-year annualized returns are ~18%.

- Mutual Funds: There are thousands of mutual funds out there – small/mid/large cap, US/international, different sectors, risk profiles, etc. – MorningStar is a good resource to research mutual funds. The risk/return depends on the nature of the fund you pick. The one thing to keep in mind is – about 65%-80% of them underperform S&P 500 benchmark index.

- Cherry Picking Stocks: US has 2 major stocks exchanges (NYSE & NASDAQ) plus a few other smaller ones. Across these exchanges, there are thousands of stocks available to pick and choose. Cherry picking stocks in the hope of landing a 10-bagger Magnificent 7 seems to be the favorite pastime of most middle-aged men.

- Active Trading: Cherry picking and investing in stocks for the long-term over months/years is one thing. However, one can more actively trade stocks, options, futures, forex, commodities, leveraged ETFs, etc. This is a more active/leveraged form of #7.

- Alternative/Exotic Investments: US being a capitalistic society, depending on your knowledge, net-worth and appetite for risk, you have a range of exotic investment opportunities such as crypto-currencies, hedge/VC funds, art, horses, oil and gas limited partnerships, etc. Heck, if you have the money, you can even buy a banana art for $6.2 million and eat that banana!

- Do a Startup: In my view, everyone should do a startup once (i.e. start a startup from scratch, not just working in a startup with a salary). Doing a startup is an extreme form of high-risk high-reward investment – you are investing your own capital, time and sweat equity into a startup with a hope of making it big. This is one of those investments where neither success nor failure is guaranteed, the only guaranteed return is learnings!

Recommended Option: Having done all of the above (except for #9), I would lean towards a combination of “#5 Index Funds” & “#7 Cherry Picking Stocks”. In fact, if I could rewind the clock and advise my younger self, I would do allocate my savings 40% SPY, 40% QQQ and 20% Cherry Picking Stocks. Here is why:

- 40% SPY & 40% QQQ allocations:

- Good Steady Returns: SPY returns ~13% per annum over long periods of time (years/decades) while QQQ does ~18%.

- Simple, Diversified, Scalable: Buying SPY/QQQ takes a few seconds, no additional baby-sitting needed to manage your portfolio. When you buy SPY, you get automatic exposure to S&P 500 – a set of 500 companies that represent the broad market across all 11 sectors (tech, finance, consumer discretionary, healthcare, industrials, real estate, materials, energy, staples, communications). On the other hand, QQQ is tech heavy. Whether it’s hundreds of dollars or hundreds of thousands of dollars late in your career, the approach remains the same – buy them with a click of a button and watch the portfolio grow over years. The key is to stay the course and dollar cost average during rough years (e.g. 2022, 2008, 2000).

- Automatic Rebalancing & Exposure: Both SPY and QQQ are rebalanced quarterly – i.e. dud companies are removed, hot companies are added. Which means, your investment in SPY/QQQ is also automatically pruned/rebalanced without you having to do anything. For example, if and when OpenAI goes public, they will likely get added to the QQQ index and you will automatically get exposure to OpenAI.

- Automatic Tailwind: Hundreds of Billions of dollars are invested in an index fund like SPY and QQQ – think of all those 401Ks and pension funds funneling their flows into SPY & QQQ. This constant flow of money into SPY and QQQ provides a tailwind for SPY and QQQ to perform well over the long term.

- Low Expense Ratio: Because SPY and QQQ are mirroring the index, they have super low expense ratios.

- 20% allocated to Cherry Picking: The act of cherry picking stocks with your hard earned money gives you an opportunity to learn about economy, business, details about the companies you pick, fundamental/technical approaches to investing etc. Your picks will most-certainly lag the performance of SPY/QQQ, but you will learn a lot in that process. Think of the losses/underperformance as the price of education!

For somebody starting off in life, I can’t think of any other asset class where the benefits of automatic tailwind (of retirement investment flow) + automatic rebalancing ensures that your investments can only grow over long periods. The downside – no bragging rights that you get with cherry picking, does not make an interesting cocktail conversation, boring as watching grass grow on a sloth!

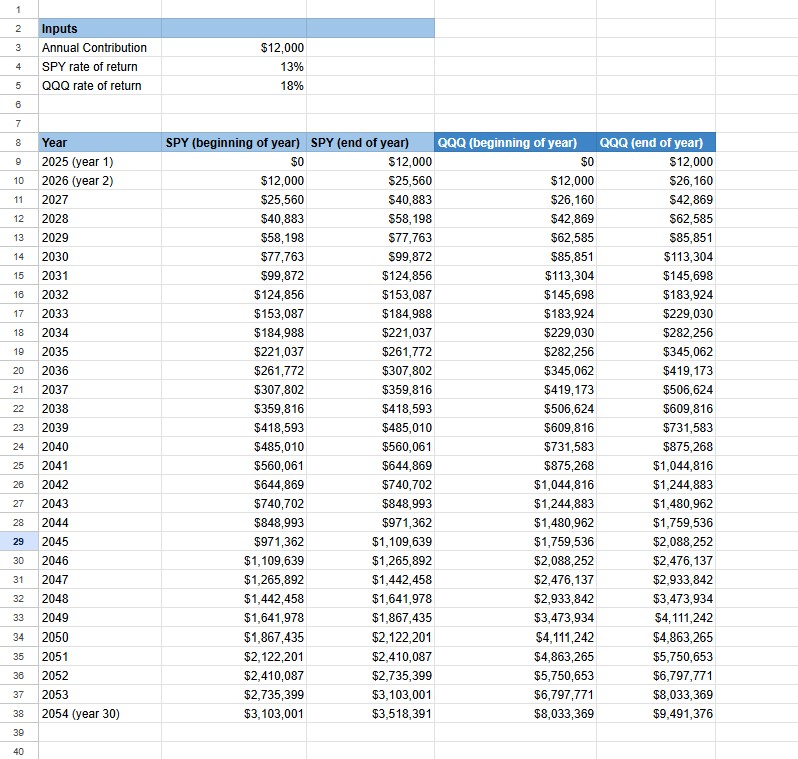

If one were to follow this strategy, what would be the end result? Assuming a $12k annual investment (i.e. $1000 per month) for a typical career length of 30 years, depending how one allocates the portfolio across SPY & QQQ, the end result will likely land somewhere between $3.5 million and $9.5 million (see the below spreadsheet) – not bad for a simple/boring strategy! So what did my first-born choose? Let’s just say she didn’t disappoint (at least for now), I’m looking forward to seeing how her approach evolves over the coming years😊