Credit cards are like sins, enjoy now & pay later!

– Anonymous

Flatbush National Bank of Brooklyn was the first bank to issue a credit card in 1946. By the end of 2017, just within US, there were 364 million open credit card accounts with Chase, Capital One and Bank of America as the 3 biggest credit card issuers. An average American today has 2.9 to 3.7 cards. Saying that this space is “hyper-crowded” would be an understatement.

In this mature hyper-crowded landscape, Apple launched their Apple Card earlier this week. In this blog post, I’ll try to analyze the elements underlying the Apple Card product strategy while delegating the other aspects (financial features, benefits, comparison with other cards, etc.) to the trade rags.

Let’s start with the onboarding experience which I believe is a core part of the Apple Card product strategy.

Onboarding Funnel & Friction: Every product team tries (to a varying degree) to manage their onboarding & adoption experience, but very few v1.0 products deliver a perfectly polished onboarding experience. Apple Card v1.0 managed to deliver that, any traces of onboarding friction has been nuked with a vengeance.

Earlier this week I got an invite email to apply for the Apple Card. Clicking the invite (in iOS Mail) took me into the iPhone Wallet app to start the credit card application process. Since Apple already knew my name, phone, email, address, etc. everything in the form was prefilled. The only 2 pieces of information I had to enter was my annual income and last 4 digits of social – that’s it. The Wallet app did beep-boop for 3 seconds and confirmed that Goldman Sachs approved my application for $20k. This entire journey of “credit card application → Goldman Sachs approval → accept card -> card added to Wallet → make it default for all Apple payments → enable for Apple Pay → ship a physical card? → card ready for use” took less than 90 seconds – yes, less than 90 seconds. Apple made it sure that if you had an iota of curiosity/intent to get the Apple Card and clicked a button or two, you will end up with the Card – it was that frictionless!

In contrast, Wells Fargo bank that has known me for 20+ years, wants to know my mother’s maiden name, housing status, monthly mortgage payment, employment status, occupation, current employment length and half a dozen other data points before it takes me to the next step… fuhgeddaboudit!

Card Experience: A lot has been written and ooh-aaah’ed about the Apple Card user experience, benefits, comparison with other cards, etc. (see this, this and this). I won’t repeat the details, but I’ll mention top 10 highlights for the sake of context and completeness. Like all things Apple, the Apple Card experience in the Wallet app is well polished where you can see: [1] how much you spent, where, in what categories [2] card color is a heat map that reflects your spending pattern [3] merchant details, location, etc. [4] weekly/month spending trends [5] cash back amount that you accrued [6] setup end of the month payments [7] your credit limit, available credit, APR [8] push notifications when your physical card is about to be delivered [9] 1-click activation of the physical card [10] reach Apple Card support via text messages (that’s really cool).

The end to end Apple Card experience is tailor made for the impatient gen Z iOS kids who grew up suckling on the iPhone teat. As they come of age ready for credit cards, at least in US, I’m betting that they will gravitate towards Apple Card’s mobile-first experience rather than a Chase or Wells Fargo card.

Ecosystems, Moats & Switching Costs: When you are a large company with many products, you try to gain “unfair advantages” by doing proprietary integrations into your own ecosystem. Microsoft products tend to be integrated into Windows & Office franchise. Google products are integrated into their own portfolio – gmail, maps, Android, calendar, hangouts, etc. Predictably so, Apple weaved the Apple Card experience with their Wallet, Apple Pay, etc. In addition, they did a couple of things very subtly that I thought were really interesting.

- Apple Card comes with 2% cashback when you use it via Apple Pay. However, this cashback declines to 1% if you use the physical card. Apple really wants you to use Apple Pay and not that plastic card. In 5 years since its launch, Apple Pay is accepted at 65% of all retail locations and 74 of the top 100 merchants in US. With the combination of Apple Card + Apple Pay, they want to continue moving the needle from 65% towards 100%. Besides, using the Apple Pay via iPhone is supposedly more secure than using the plastic card – an aspect I’m not familiar with.

- In all these years, Apple had my credit card details to charge my AppStore purchases. Now, to pay the Apple Card balance at the end of the month, I had to give them my bank checking account details – something they never had access to. I am willing to bet that Apple will use my bank account details in a meaningful manner down the road.

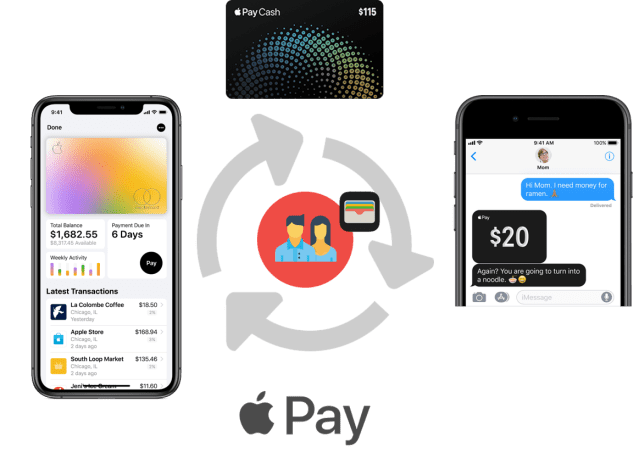

- The 1%/2% daily cashback from your Apple Card spending goes into your Apple Cash debit card (issued by Discover) and NOT into your Apple Credit Card. In all these years, like most users, I never bothered using Apple Cash Card. With this move, Apple is herding its users to use Apple Cash Card in additional to the Apple Credit Card. Now that I have $8 in my Apple Cash debit card, Apple hopes that I’ll use it for Starbucks cappuccinos or for peer-to-peer cash payments (paying your co-worker for lunch) via iMessage rather than PayPal/Venmo. The execs at PayPal/Venmo just got served!

With all this, Apple is not only strengthening its ecosystem, but also adding another layer of moat around its active user base of 1.4 billion Apple devices (that include 900 million iPhones). The fruit company wants to make sure that the Pirates of Android can’t easily pillage its iPhone user base.

Financial Flywheel: Till about a month ago, Apple’s financial flywheel was “Wallet + 3P Apple Pay”. 3P Apple Pay here refers to the Apple Pay experience with credit cards issued by 3rd party banks such as Wells Fargo, Chase, BoFA, etc. These banks issue hundreds of millions of credit cards to consumers using their existing systems & processes – i.e. the business as usual incumbent model. With these old guard banks, Apple had limited control & innovation ability on the credit card experiences with iPhones/iPads. Now with a willing partner like Goldman Sachs, Apple can rethink & innovate the end-to-end credit card experience with iPhones/iPads – i.e. 1P Apple Card & 1P Apple Pay. Now, Apple’s financial flywheel is “Wallet + 3P Apple Pay + 1P Apple Card + 1P Apple Pay + Apple Cash Card + iMessages + your Checking Account”. Reeling in Apple Cash debit card into its payments flywheel is brilliant!

Overall, what was Apple’s approach & strategy with Apple Card?

It’s First Principle Thinking!

When launching a new product in an existing hyper-crowded segment, it’s very easy to fall into the trap of emulating others. Apple successfully avoided that trap with their First Principle Thinking:

- What are customers’ pain points with credit cards?

- How can I solve them better than others for my (iOS) customers?

- What’s my differentiation from competition?

- What’s my “unfair advantage”?

- How do I ensure easy adoption & usage?

- How do I weave it into my ecosystem and flywheel?

- Who are my partner/dependencies? How do I choose them to serve my strategy?

The Apple Card experience is a reflection of that First Principle thinking. To execute on those vectors, with Goldman Sachs as the card issuer, Apple found a partner with the necessary financial gravitas who Apple could bend to their will and not be bogged down by incumbent thinking (i.e. this is how we have always done it). In fact, Apple’s official tag line “A new kind of credit card. Created by Apple, not a bank” reflects their First Principle approach to delivering a meaningful Apple Card experience!